6 Apps Like Perpay - Buy Now, Pay Later Made Easy

In the world of modern shopping, convenience and flexibility are paramount. Enter the realm of “buy now, pay later” (BNPL) apps, where you can snag your favorite items without the immediate financial strain. Perpay, with its unique blend of shopping, credit-building, and transparent payment options, has gained popularity among savvy consumers. But what if you’re curious about alternatives? Fear not! We’ve curated a list of 10 apps like Perpay that offer seamless shopping experiences and credit-building opportunities.

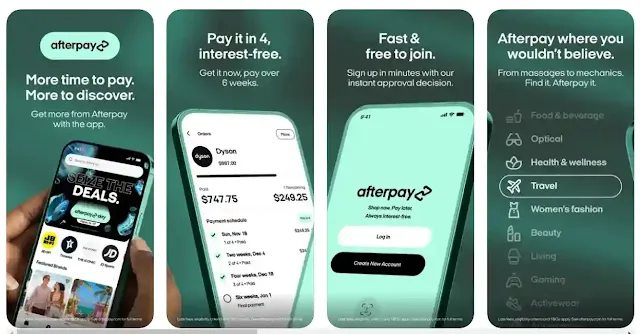

1. Afterpay

Afterpay is a popular buy now, pay later (BNPL) service that allows you to split the cost of your purchases into four interest-free payments. The main features of the service include immediate use, as you can set up an Afterpay account instantly without a lengthy application process. The service is also seamlessly integrated into online stores, allowing you to easily use Afterpay during checkout. Additionally, Afterpay is fee and interest-free, with the company's revenue coming from merchant fees instead. Afterpay users can also access exclusive shopping deals and curated shopping guides through the app. Finally, the service allows users to manage their orders, review order history, adjust payment schedules, and link to Cash App.

Pros:

- Convenience: Quick setup and easy usability.

- No Interest: No interest charges on repayments.

- Wide Retailer Network: Partnered with many brands.

- Exclusive Deals: App-only discounts and curated content.

- Flexible Payment Plans: New options for 6 or 12 months.

Cons:

- Impulse Spending: Potential for overspending.

- Limited Consumer Protections: Less regulation than banks.

- Late Fees: Accumulate if repayments are missed.

- Easy Signup: May lead to financial strain.

- Not Reported to Credit Agencies: Doesn’t impact credit score

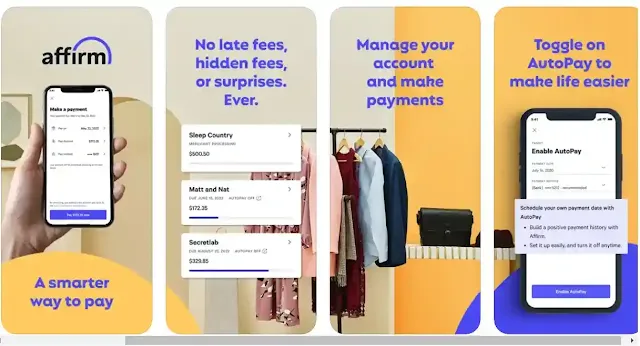

2. Affirm

Affirm offers a convenient way to shop stress-free and pay over time. The service provides flexible payments, allowing users to pay for purchases over time at almost any store. Affirm also offers exclusive deals, including rates as low as 0% APR and exclusive discounts. Additionally, the service makes it easy for users to manage their accounts and make payments. Affirm further provides users with the option to open a high-yield money account with no minimums or fees.

Pros:

- No Fees: Affirm doesn’t charge monthly fees.

- Usable Everywhere: Use the Affirm Card online or in person.

- Payment Plans: Request payment plans for big purchases.

- High-Yield Account: Open a money account with attractive rates.

- Simple Shopping: Choose payment terms that fit your budget.

Cons:

- Single Interest-Free Option: Only one interest-free choice.

- Complaints: Some users report a high number of complaints.

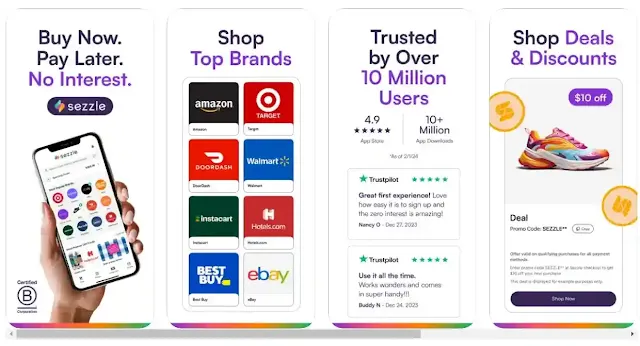

3. Sezzle

Sezzle offers a convenient "buy now, pay later" solution that allows you to split your purchases into four interest-free payments, providing ultimate shopping flexibility. With instant approval decisions and no hard credit checks, you can start using Sezzle without worry. By splitting your payments over time, you can better manage your budget and improve your credit score, as Sezzle reports your payment activity to major credit bureaus. Furthermore, responsible use of Sezzle can increase your spending limit, giving you more financial freedom. The service also provides payment reminders, helping you stay on top of your due dates and effectively manage your budget.

Pros:

- Interest-Free Loans: Enjoy the convenience of splitting payments over time.

- Credit Building: Sezzle reports payment activity to major credit bureaus, helping you build credit.

- No Hard Credit Checks: Instant approval decisions without affecting your credit score.

- Exclusive Deals: Access special offers with select merchants.

- Easy Rescheduling and Budgeting: Manage payments effectively.

Cons:

- Complex Fee Structure: Some users find the fee system confusing.

- Limited Visibility of Credit Limit: It’s not always clear how much you can spend.

- Credit Reporting Complaints: A few users have raised concerns about credit reporting.

- Frequent Changes in Terms: Sezzle’s terms can be confusing and subject to change.

- Late Payment Fees: Be aware of potential fees for missed payments

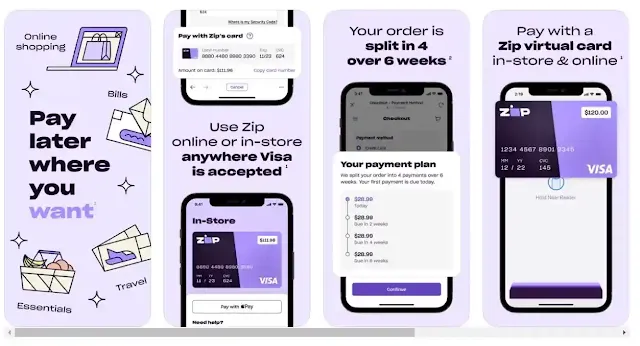

4. Zip

Zip (previously known as Quadpay) offers a smarter way to shop now and pay later. With Zip, you can split your purchases into four easy installments to be paid over six weeks. This flexible payment option can be used both online and in-store, wherever Visa is accepted. The best part is that Zip is interest-free, making it a great alternative to credit card interest. Using Zip won't impact your credit score either. Getting started is simple - just install the Zip app, link your payment card, and you're ready to start shopping.

Pros:

- Interest-Free Payment Option: No interest charges.

- Soft Credit Check Approval: Won’t harm your credit score.

- Wide Acceptance: Use it at various retailers.

- Reschedule Payments: Flexibility to adjust due dates.

- No Credit Impact: Safe for your credit history.

Cons:

- Convenience Fee: $1 per transaction.

- Late Fees: Up to $10 for missed payments.

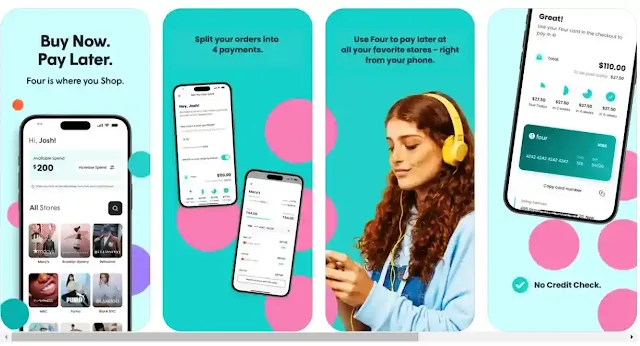

5. Four

Four is a "shop now, pay later" service that allows you to split your purchases into four equal, interest-free payments over the course of 8 weeks. This is a convenient payment option that makes it easy to manage your spending. The Four app allows you to track your orders, payments, and payment history, so you can stay on top of your budget. The service is also flexible - you can manage your payment methods and receive timely notifications to help you stay on top of your due dates. Overall, Four provides a simple and hassle-free way to pay for your purchases over time.

Pros:

- Interest-Free: No additional charges.

- Hassle-Free Shopping: Simplified experience.

- Payment Tracking: Stay organized.

- Retailer Partnerships: Access a wide range of stores.

- Payment Flexibility: Manage due dates.

Cons:

- Late Fees: Possible penalties for missed payments.

- Limited Payment Options: Only available every 2 weeks.

- No Rewards: No cash back or rewards earned.

- Potential Overextension: May encourage impulse spending.

- Credit Impact: Late payments could affect credit score

6. Klarna

Klarna offers a convenient "shop now, pay later" solution that makes the shopping experience easier than ever. With Klarna, you can enjoy personalized inspiration, such as curated deals, collections, and looks tailored to your preferences. The service also allows you to save your favorite items and share them with friends. Klarna provides exclusive daily deals updated regularly, so you can take advantage of discounts worldwide. The app gives you instant information on your purchases, including delivery tracking, so you can stay on top of your orders. Klarna even offers price drop alerts, so you can save items and get notified when the prices decrease. To help you stay organized, the app sends payment reminders to ensure you never miss a due date. And if you need to make a return, the process is hassle-free - you can report it directly through the Klarna app. Klarna's features make shopping and managing your purchases a breeze, allowing you to shop now and pay later with ease.

Pros:

- Flexible Shopping: Pay later for purchases.

- Price Alerts: Never miss a discount.

- Easy Returns: Hassle-free process.

- Personalized Inspiration: Curated suggestions.

- Comprehensive Overview: Manage payments seamlessly.

Cons:

- Late Fees: Possible penalties for missed payments.

- No Credit Building: Klarna doesn’t help build credit.

Post a Comment